Elimination of the most serious rival to CBDCs currently underway

Crypto is the last barrier to CBDCs rolling out globally. The attack on it is now underway in earnest!

One of the most well known and widely mentioned quotes from “The Art of War”, written by the Chinese General Sun Tzu in the 5th century BC (that’s over 2,500 years ago!) is:

"The supreme art of war is to subdue the enemy without fighting."

With every day going by, I am becoming more and more convinced that the enemies of humanity have studied Sun Tzu’s book, which is still mandatory reading to this day in almost every military academy and officer training program globally, very very carefully and that it is somewhat of a bible for them (another one being this book written by Gustave Le Bon in 1895).

They are manoeuvring their pieces in this grand game of chess in such a way that when you look at each of their moves in isolation, it is practically impossible to understand their ultimate objective.

Only when you group their moves together and apply the Action-Consequence Principle can you start to see what the end game is.

This article is all about doing just that and my objective in writing it is to show you in a clear and undeniable way how the recent moves against cryptocurrency happening around the world (but especially in the US and other western countries) are all about clearing the way for the rollout of CBDCs on a global scale.

True to our motto of the truth setting you free….but only if you ACT on it, I will also outline in simple terms what actions we can all take in order to beat the enemy in their own game and stop them in their tracks.

But first, a short introduction on what cryptocurrencies and CBDCs are in case you are not quite familiar with them yet. If you are, feel free to skip this to get into the ‘meat and potatoes’ of this article.

What is a Cryptocurrency?

The Merriam-Webster dictionary defines “cryptocurrency” as:

Any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions.

(emphasis added on purpose)

For an outfit that went to the extent of changing their definition of the term “vaccine” to suit a certain narrative, they have done a pretty decent job with this term.

The “decentralized system” mentioned in the definition above is what’s called a Distributed Ledger Technology (DLT) of which Blockchain is the most well-known kind (but definitely not the only one).

DLT is a truly profound technological breakthrough which can be used for a lot more than just cryptocurrencies. It can literally replace almost all major functions of government on a global (and even inter-planetary) scale but its most urgent and powerful use in my opinion is to create a decentralised financial system which is urgently needed!

The concept of Blockchain was first revealed to the general public on October 31, 2008 with the release of a research paper describing:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

This “peer-to-peer version of electronic cash” was called by the paper’s author “Bitcoin” and the rest as they say, is history…

Speaking of the paper’s author, it is now an indisputable fact that Satoshi Nakamoto is not his/her/their real name and that it is very unlikely that person or a group of people are actually ethnic japanese despite stating on their profile page to be a “37 year old male from Japan”.

The fact that ‘Nakamoto’ chose to not reveal who they are has raised concerns and rightfully so but nevertheless, the “Blockchain” technology (the first ever DLT!) described in great detail in his paper, including the cryptography mechanism which secures it (known as “proof-of-work”) have been analysed and studied by many thousands of cryptography experts and technologists and has been found to be sound.

Most importantly, while many cryptocurrency exchanges and related services have been hacked since the emergence of DLTs, the core security mechanism of the Bitcoin network itself has never been compromised.

What is a CBDC?

Have you noticed that I emphasised the word “usually” in the dictionary definition above:

Usually has no central issuing or regulating authority

As I said already, the Merriam-Webster dictionary have actually done a great job with their choice of words because by adding the word “Usually”, they excluded the option of “Never has a central issuing or regulating authority”.

This means that a Central Bank Digital Currency (CBDC) is a type of cryptocurrency by definition.

However, it is literally the exact opposite of Bitcoin and the overwhelming majority of other major cryptocurrencies which exist today!

This is because a CBDC DOES have a “central issuing or regulating authority” and that authority as the name suggests is a Central Bank.

Such Central Bank can be a national Central Bank (such as the Fed in the US, the Bank of England in the UK and the Reserve Banks of Australia and New Zealand respectively) but can also be a supranational Central Bank such as the European Central Bank and even a global Central Bank such as the Bank Of International Settlements (BIS) or the World Bank.

Interestingly enough, all the three types of central banks mentioned above, as well as the specific central banks themselves, are actively and heavily involved in their own CBDC projects.

If you want to further understand CBDCs and their characteristics, I’ve already written a detailed introduction in the post below:

The inevitable bank collapses will be used to usher in Central Bank Digital Currencies (CBDCs)

At the end of last week, the news came out that the large US Bank, Silicon Valley Bank (SVB) “collapsed suddenly” and taken over by the FDIC. Below are two videos from independent media journalists covering this story. The first is just a quick runthrough of the facts:

The War on Crypto

While I already wrote on this topic briefly, I am going to expand on it further here as there have been some big developments in this area this month (June 2023) which, in my opinion, make it absolutely crystal clear what the enemy’s end game is.

Let’s start with this press release by the US Securities and Exchange Commission (SEC) from just over three weeks ago regarding action they are taking against Binance, one of the biggest cryptocurrency exchanges in the world and more specifically, one of the biggest providers of exchange facilities between cryptocurrencies and government-issued currency such as the US Dollar, Euro and Pound (also known as “Fiat currency”):

A mere day later, the SEC issued another press release with this one discussing legal action they are taking against Coinbase, the single biggest Cryptocurrency exchange in the US and also an American Public company listed on the NASDAQ.

I find this ‘coincidence’ very interesting and specifically the timing and almost identical charges and other terms used in both press releases.

If there is one thing I learnt having lived through the last three years, is that there is no such thing as coincidence!

You may disagree at this stage but as I will shortly demonstrate, there was definitely no coincidence when it comes to the recent moves by the SEC and they are part of a meticulously created plan to take out the ability of everyday people to move between fiat and crypto, unless it is done in a manner the enemy and their cronies in government can control.

A mere day after the SEC’s takedown of Coinbase (and two days after the takedown of Binance), this happened:

In case the name “Soros Fund Management” doesn’t set alarm bells ringing for you, here is what their own website is saying:

Soros Fund Management LLC (SFM) is the principal asset manager for the Open Society Foundations (Open Society) – the world’s largest private funders of independent groups working for justice, democratic governance, and human rights. SFM was originally founded by George Soros in 1970, and its financial success enabled Mr. Soros to create Open Society to pursue his philanthropic vision. Today, SFM’s mission is to protect and grow Open Society’s resources.

Soros Fund Management is also a “strategic partner” of the World Economic Forum, just like the Bill & Melinda Gates Foundation, together with Soros’s Open Society Foundations, which it is “on a mission to protect and grow”.

If you still hear no alarm bells ringing at this stage, you obviously need some introduction to the basic lay of the land and who the “enemy” is. Hopefully the below will help you get up-to-speed:

Who are "THEY" exactly?

Watch now (50 mins) | Since the start of the COVID-19 Plandemic (let’s use the correct terminology because it’s extremely important to do so in the age of fifth generation warfare), and especially as “the great awakening” is gathering steam, some of the most common terms being used by people are “they” and “them” when referring to our opponents who have been doing

Hopefully by this stage you’d agree with me that any time Soros and his cronies (of which there are many in every aspect of society, including in the US legal system) see something as being positive that very something spells some seriously bad news for the rest of us!

This is no different. If Soros henchwoman Dawn Fitzpatrick thinks that the crypto industry is “ripe” to be taken over by the big banks and capital venture funds like hers (which is what “TradFi” or Traditional Finance means), she almost certainly has access to some information you don’t and most importantly: if this does indeed happen, it will be very very bad for you and me!

In case you have any doubt whether Ms. Fitzpatrick had access to some information most other people didn’t when she said the above, this happened a mere week later:

In the very unlikely event that you never heard the name BlackRock before, they are the biggest asset manager on Earth and a strategic partner of the World Economic Forum.

Their founder and CEO, Laurence (Larry) Fink is a board member of the World Economic Forum and a confirmed co-conspirator in the global plandemic!

He also has this tool at his disposal which has been around for over 20 years:

BlackRock doesn’t just trade the markets. BlackRock IS the markets!

It is also interesting to note how BlackRock has no issues whatsoever with using the embattled Coinbase as the custodian for its new Exchange Traded Fund (ETF), despite the several pending charges by the SEC against it.

As there are no coincidences in our world anymore, it should make you wonder…

If you still think that coincidences can and do happen, here is some news that came out a mere five days later:

Let’s recap:

A cryptocurrency exchange backed by some of the biggest names in “TradFi” (Traditional Finance) LAUNCHES TO THE PUBLIC while the biggest incumbents in the US (and thus, its biggest competitors) are being ‘investigated’ by the SEC.

Cool and normal, right?

Remember, Schwab, Fidelity and Citadel which are the three major TradFi players behind this brand new crypto exchange have launched EDX Markets at around the same time that both Binance and Coinbase (a publicly listed company) are facing some major headwinds due to moves by the US government.

This means that the formal final approval for EDX Markets was already granted by the SEC at the time that they used their regulatory power to hinder two major incumbents (and by definition, competitors to EDX Market) of the crypto industry.

If this is not market manipulation, I don’t know what it!

Not just in the US

In case you think this takedown of the major incumbents of the crypto industry is only happening in the US, here is what is happening in Europe at exactly the same time:

Germany’s Financial Regulator also has a long anti-crypto history including aggressively cracking down on Binance and other major cryptocurrency exchanges and warning European investors to stay away from Crypto altogether.

Meanwhile in Argentina, the government and the central bank there have moved way past warning and have introduced formal and strictly enforced bans on Argentinians using their own money to purchase cryptocurrencies.

All this while the purchasing power of the government-issued currency is being eroded at the fastest rate in 32 years with Argentina suffering from its worse hyperinflation since their currency collapsed in 1991.

The official annual inflation rate in the country is now 114.20% which in simple terms means that prices have more than doubled since this time last year!

Meanwhile in Australia, Commonwealth Bank and Westpac, the biggest and third biggest banks in Australia respectively have effectively banned transfers from any bank accounts held with them to any cryptocurrency exchanges.

Westpac have also debanked the Australian subsidiary of Binance which effectively killed their business in the land down under.

Finally, there is also this piece which makes it clear the war on crypto is a truly global agenda:

An especially revealing paragraph from the above article is this one:

The International Organization of Securities Commissions (IOSCO) launched a consultation in May on recommendations to guide the world’s securities regulators in overseeing crypto markets. The mantra is “same activity, same risk, same regulation.”

That may seem like a reasonable requirement for you at first but when you consider the fact that most existing cryptocurrencies are decentralised by their very nature with many also created specifically to facilitate anonymous transactions, you will quickly realise that crypto can never comply with the same regulations as traditional finance (TradFi) which is centralised and non anonymous by design.

Simple example is the KYC (Know Your Customer) regulations that apply to pretty much all TradFi products.

While a crypto exchange can comply with KYC (and most of the ones that convert between fiat and crypto do), once the funds are in the crypto world, they can be moved out of these exchanges and into crypto wallets controlled by individuals (which is the best practice anyway). These are known as self-custody wallets.

Such wallets do not collect or store any details about their owners and this is by design! They are also not controlled per se by any central authority so there is really no way for anyone to enforce anything on all the people holding a self-custody wallet which means regulating them in the same way that your bank or brokerage account is regulated is technically impossible. This is a fundamental characteristic of the crypto ecosystem and the people at the International Organization of Securities Commissions (IOSCO) absolutely and definitely know it!

They are knowingly imposing regulations and requirements which they know that crypto can never ever comply with! Their ultimate agenda is to take over crypto and corrupt its very essence!

Preston Pysh, who hosts the very popular Bitcoin Fundamentals Podcast, summed this whole thing best when he said this:

CBDCs going global

While the war on crypto rages on, the enemy is also busy finalising its control grid which is based on CBDCs enabled by digital IDs or as like to call it: The FINAL enslavement.

in Australia, a national digital ID scheme is about to be rolled out which will also include facial recognition! Similar national digital ID schemes are being rolled out in the EU, UK, US, Canada, New Zealand and most of the rest of the former so called “free world”.

Meanwhile the UN has come out with a very detailed proposal for a global digital ID linked to people’s bank account or mobile wallet to supposedly “address Wealth Inequality in the Digital Era” as part of their sustainable development goals. Such global digital ID will be based on biometrics such as your fingerprint and facial features (and ideally both as far as the UN is concerned).

This UN plan is literally copy/paste of a World Economic Plan introduced by Klaus & Co. as far back as 2016 (same year the now infamous “you’ll own nothing and be happy” video was posted by them on social media) which further proves that the UN and the WEF are one and the same.

Then we also have this recent move by the World Health Organisation for the rollout of global digital vaccine passport!

The Digital COVID-19 Vaccination Certificate goes GLOBAL - our "do or die" moment

Watch now (2 min) | Forget E-V-E-R-Y-T-H-I-N-G the merry band of global psychopaths are throwing at us right now! The CBDCs, the SDGs and so called “Climate Emergency”, the Transgender agenda, the crimes against humanity facilitated by the virus they created and the ‘vaccines’ they introduced

You can no doubt see that integrating the UN’s global digital ID system which has all your biometric data with the WHO’s global digital vaccine passport, which has all your vaccination information and in the very near future all other health data, will be trivial, especially given the fact the WHO is part of the UN!

The BIS is leading the charge

While the UN and WHO are busy creating the global digital ID infrastructure, other enemy operatives are hard at work creating the single global CBDC that will be enabled by said global digital ID.

This effort is spearheaded by a single entity: the Bank of International Settlements (BIS) commonly referred to as “the central bank of central banks”.

I’ve already covered some moves by the BIS to create a single global CBDC but since I wrote that, the BIS has really stepped up their efforts and have rolled out two major initiatives that are very concerning, to put it mildly.

Project Mariana

Project Mariana is an initiative of the BIS, together with the central banks of Switzerland (the WEF’s home turf), Singapore and France.

Its objective is to create a system where CBDCs of different countries can be easily traded against each other and the end game is to completely replace the existing global Foreign Exchange (Forex) market.

This is kind of a big deal given the Forex market is the biggest global market on Earth by orders of magnitude. Just to give you an idea of its size, as of April 2022, the daily trading volume on the global forex market is 7.5 TRILLION Dollars. Let that sink in for a second!

The global Forex market is dominated by nation states and their central banks and is the one single most important thing keeping our financial system as we know it ticking along.

Here’s the ‘marketing spiel’ for Project Mariana directly from the horse’s mouth:

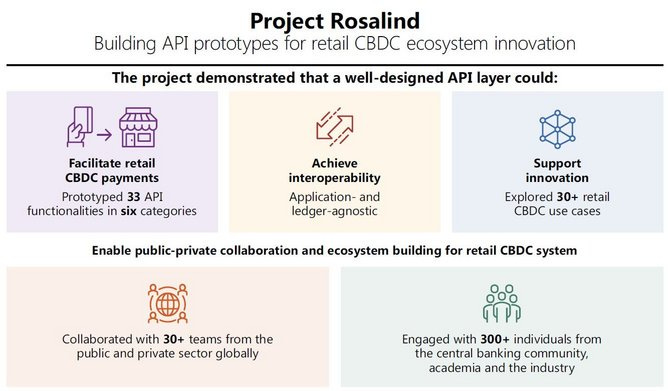

Project Rosalind

Project Rosalind is a joint initiative of the BIS with the Bank of England, the UK’s central bank.

The objective of this project is to create infrastructure built through a public-private partnership (or as the WEF calls it “stakeholder capitalism”) that will enable commercial entities such as banks and financial technology (FinTech) companies to offer their services to the general public through CBDCs instead of the fiat currencies we use today.

In the BIS’s own words:

Based on a two-tier distribution model (central bank at the foundation of the retail CBDC system and customer-facing activities carried out by the private sector), the objective is to explore how this interface could best enable a central bank ledger to interact with private sector service providers to safely provision retail payments.

I think that’s pretty self explanatory.

The BIS also included a diagram of how their “two-tier distribution model” will work:

As usual with their projects, they also have a slick marketing video attempting to promote this construction of a ‘digital gulag’ as the best thing since sliced bread and why you should get excited about it.

How does the War on Crypto facilitate the rollout of CBDCs

Decentralised (and ideally also anonymous) cryptocurrencies are the single biggest threat to CBDCs! There is no question about it and the enemy knows it!

Such cryptocurrencies operate completely independently of any central bank, government or commercial entity and enable everyday people to transact with each other quickly and cheaply (Bitcoin is probably the one glaring exception to this) regardless of where they are on the planet.

Furthermore, because these currencies use Distributed Ledger Technology (DLT), they do not have a single point of failure and cannot be shut down by anyone!

As long as people can access the Internet as we know it today (or something similar to it) in some way, shape or form, they can transact with each other. There are even ways to exchange cryptocurrencies without direct access to the Internet but that’s a discussion for another time.

To put it in very simple terms: if the government shoves CBDCs down your throat and you refuse and as a result get cut off of the financial system as we know it today, cryptocurrencies offer you a viable alternative to keep transacting with others, especially if they are not in close physical proximity to you.

And this is exactly why the enemy has launched the biggest frontal assault on crypto since the Bitcoin whitepaper was published. They are trying to eliminate the only thing which offers a viable alternative on a global scale!

They are also trying to catch up after ‘missing the train’ so to speak and losing the opportunity to make a bunch of money from this revolutionary emerging technology.

As an example, the very same CEO of BlackRock who is in the process of launching a Bitcoin ETF as discussed above, referred to Bitcoin as an “index of money laundering” as recently as 2017. Guess he decided to do some “money laundering” of his own…

If you want to dig a bit deeper into this, below are two great videos which do just that and make the connection between the crackdown on crypto and the agenda to rollout CBDCs on a global scale.

What can you DO about this?

Actionable Truth Media is all about empowering people to ACT on the Truth.

My colleagues and I are not really in the business of ‘fear porn’ and adding to the doom and gloom by telling the people of the world some uncomfortable truths and then just leaving them to ‘simmer in their own juices’ so to speak.

This is counterproductive and demoralising. Demoralised people can’t fight a war (which is exactly what we are in now. This is World War 3!) effectively, not to mention win it.

So what now?

Practical action steps:

You must do everything humanly possible to stop or at least delay the rollout of CBDCs, both nationally and globally. The most effective way to do that is to block any attempts by governments to roll out a digital ID, no matter how beneficial they claim these things to be. Digital IDs are a crucial enabling mechanism for CBDCs. Without digital IDs, there are no CBDCs. It’s as simple as that! I’ve written extensively on what we can all do to stop digital IDs in their tracks and you can read all about it here.

You must ensure that the banking system in your country is not consolidated into several big players as this will make the rollout of CBDCs much easier. Support small banks and don’t buy into the government narrative of “too big to fail” which tries to convince you that your money is safer in one of the big banks instead of a small one. I wrote an entire lengthy post about it which you can read here.

Have other means of transacting that are not through the fiat currency system or are reliant on the banks. This may become crucial once the current financial system collapses (which is a mathematical certainty! It’s not if, it’s when) or you get ‘shut off’ from it by your government because you said no to CBDCs or some injection they want you to take. I am not here to give anyone financial advice and as a sovereign human being, you are solely responsible for any action you take or refrain from taking but some of those “other means of transacting” can include:

Cryptocurrencies - this is a big topic in on itself and does have a steep learning curve if you are not familiar with it at all. Most importantly: there is no customer service or support line you can call for the crypto of your choice. You’re entirely on your own (which is exactly the point!). If you want to learn more about Crypto, I am happy to write a detailed guide on it. Just let me know in the comments below that you’re interested and ideally also what specifically you’d like to learn about.

Physical Precious metals - Unlike cryptocurrencies, using physical precious metals such as gold and silver means that you are restricted to transacting with people who are in close physical proximity to you. On the flip side though, you are not dependent on having access to the Internet. If the Internet or the power grid go down, you can still transact.

The key though is to hold PHYSICAL precious metal and have it under your direct control. Precious metals ETFs and certificates for allocated or unallocated precious metals are no good. This is because:You cannot be sure there is actually any physical metal backing these paper or electronic claims; and more importantly

You cannot easily access your precious metal when you need it. This point also applies equally to buying physical precious metal and keeping it in someone else’s safe or storage facility. If it’s not in your possession, it’s not really yours.

Buying Bullion is also problematic in my humble opinion as these are not practical to transact with for cheaper everyday items such as food, water and petrol/gas.

Personally, I am buying 1oz silver coins which I feel strike the best balance of valuable, easy to transact and easy for me to store securely myself.

Items that are easy to barter - bartering has existed since the dawn of humanity and while it is not ideal, I can definitely see a possibility that we may need to resort to that, at least temporarily. They say that history is a good predictor of the future so when looking at the many thousands of years of human bartering and the operation of black markets, some of the items that were easy to barter include:

Non-perishable food (canned, dry or dehydrated) and longlife water;

Small bottles of Alcohol which can also be used as a disinfectant or fuel;

Guns and Ammo; and

Useful wilderness skills such as farming, hunting, carpentry, fixing cars and purifying water.

Whether you do any of the above or not, the one thing you definitely need is a plan. As the saying goes “Failing to plan is planning to fail” and in a SHTF scenario (which unfortunately is possible although definitely not certain in my opinion), those who are not prepared and failed to make at least some rudimentary plan will likely face a very bleak reality…or worse.

When I looked at the Australian banks shareholdings about a decade ago they were mostly owned by overseas banks (BNP, Deutschbank, JP Morgan, Barclays etc etc). The only exception was the NAB which had ~12% local ownership and the NAB in turn had shares in all the other Australian banks but they did not have the same in the NAB.

Be interesting to see what's happened now as a couple of the Corporates I've looked at lately have changed over to just being Blackrock, State Street or Vanguard.

I assume that part of the response to this should be to cut these guys out of our economic system. Not sure how good crypto is out in the bush though. Crypto seems a very urban 'solution' to me. Cash is easier & doesn't rely on modern technology, not at the retail level anyway.

I can remember bitcoin being pushed to us back in 2008 or so on some online forum I was on at the time (I cannot remember which one). I'm also sure that I was given something like 10 bitcoins at some stage as some sort of promotion of it, damned if I can find that offer again though.

BSV solves all this. Educate yourself on what really is Bitcoin. BTC is NOT Bitcoin, and BSV is NOT a cryptocurrency. https://craigwright.net/ and https://www.bsvblockchain.org/ and https://www.bitcoinsv.com/