The inevitable bank collapses will be used to usher in Central Bank Digital Currencies (CBDCs)

We MUST resist at ALL costs (and I do mean A-L-L costs)! This is our collective "do or die" moment!!

At the end of last week, the news came out that the large US Bank, Silicon Valley Bank (SVB) “collapsed suddenly” and taken over by the FDIC.

Below are two videos from independent media journalists covering this story.

The first is just a quick runthrough of the facts:

This one is a bit more in-depth and also discusses which banks may be next, and why:

BREAKING NEWS Update #1:

A third US Bank has just collapsed and taken over by the FDIC & the US department of treasury.

This one is Signature bank in New York, which like Silvergate was heavily reliant on the cryptocurrency industry for its business.

BREAKING NEWS Update #2:

The banking crisis that started in the US has now well and truly spread to Europe.

Stocks of some of the biggest banks in Europe has suffered massive drops in their prices, a mere three days after so called ‘experts’ at the biggest commercial bank on Earth said there was basically nothing to worry about when it comes to banks in Europe.

The same thing was peddled by a major legacy media outlet in Australia which is supposed to be a so called ‘expert’ on finance. The best way to sum up their ‘expert analysis’ is that they are saying that the Australian banking system is “safe and effective”.

Now where did we hear this before?

BREAKING NEWS Update #3:

Ok, so things have officially gone from bad to worse.

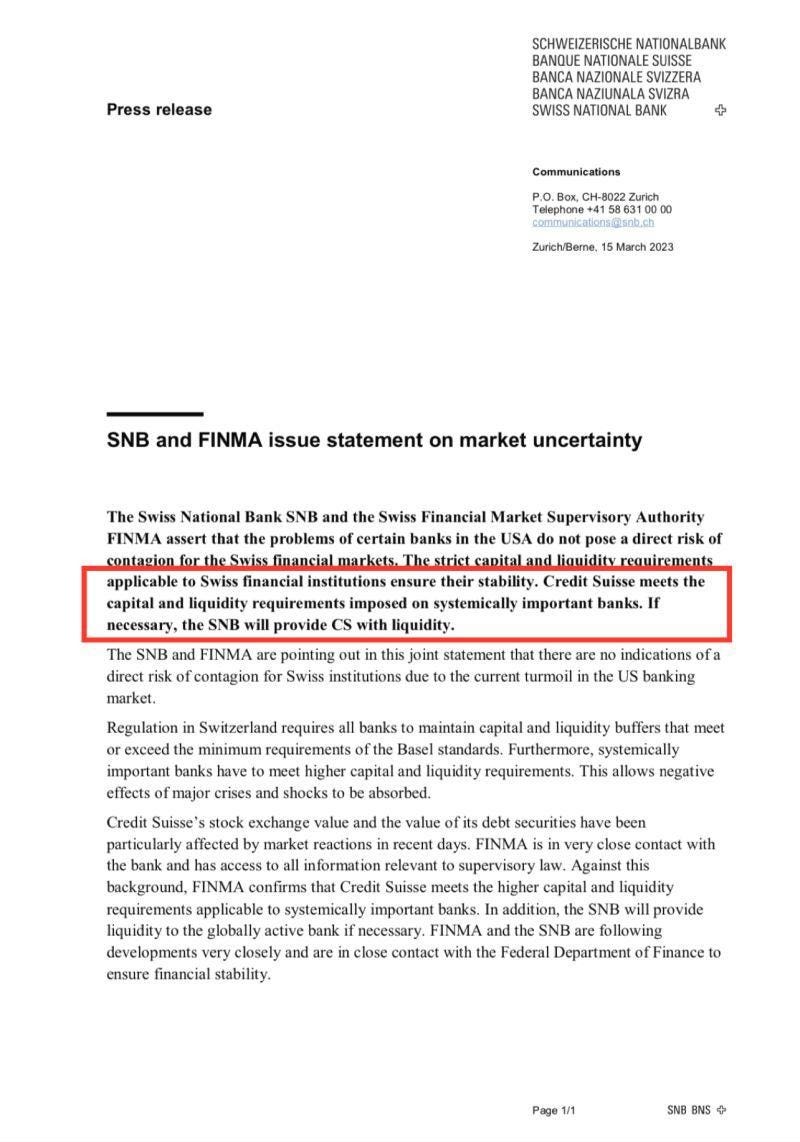

The Swiss National Bank, Switzerland’s central bank, has just announced that they will provide a ‘liquidity facility’ to Credit Suisse in the amount of 54 BILLION, an amount which completely eclipses any bailouts any bank received during the Global Financial Crisis of 2007/8!

Here is the official press release the Swiss central bank issued:

Now you need to understand that this is not a small bank catering for a niche industry like Silvergate or Signature Bank and not even a medium size bank like Silicon Valley Bank.

Credit Suisse is the biggest bank in Switzerland and one of the biggest banks on the planet!

If you want some further spin-free analysis of this breaking (and frankly, shocking!) story, Neil McCoy-Ward has done a great job in doing so in the video below:

BREAKING NEWS Update #4:

Sunday, March 19 2023 will forever be remembered in history as the “Lehman moment 2.0” with the news coming out that the embattled Swiss financial giant Credit Suisse is being taken over by its arch-rival UBS, another Swiss banking giant.

More importantly, the Swiss central bank (and therefore essentially the Swiss taxpayer), will be the one to pony up the overwhelming majority of the purchase price, not UBS!

And if you think for a second that this is where it ends and crisis has been averted, I present to you the following news for your consideration.

Basically, they are saying that the US banking system is “safe and effective”.

Where did we hear this one before?

Make no mistake: this is as big as it gets and things will move very quickly from here.

The US central bank held an emergency meeting which was held behind closed doors.

Following that meeting, the President of United States held a press conference in which he assured Americans that his administration is acting “decisively” and their bank deposits are safe and “will be available to them as and if they need them”.

However, this is not the actual story. This is simply a manufactured distraction!

Before we move to what is the actual story, I wanted to end this introductory section with a great video by Dr. Chris Martenson of Peak Prosperity who manages to provide an excellent summary of everything that has already happened as well as what is yet to come in just 12 minutes:

The REAL Story: the push for Central Bank Digital Currencies (CBDCs)

To start with, here is an 8 minute video by Independent Journalist Kim Iversen explaining how the response to the these bank collapses by US regulators and especially the Federal Reserve is actually all about:

Eliminating competition and consolidating the US banking industry to only a few massive players; and

Hurting the existing cryptocurrency industry by eliminating the ‘on and off ramps’ that allow people to move between the government-controlled fiat currency and crypto.

The above two things should pave the way for CBDCs and enable the government and central banks to make the transition with much less ‘friction’ (i.e. resistance/reluctance by the public).

Neil McCoy-Ward is making the connection that really matters in the video below which was made after the collapse of Silvergate, which like Signature bank, served mainly the cryptocurrency industry, but a few days prior to the collapse of SVB.

For a more ‘in your face’ version of an explanation of how all these banking collapses are manufactured and specifically designed to bring us all to the ultimate end game which is CBDc, check out this report by Canadian independent journalist Dan Dicks.

Dan has been in this business of fiercely reporting the truth for a very long time and is a bit of a personal inspiration of mine.

His main platform used to be a very popular YouTube Channel which he ran for over 14 years. He had over 270k subscribers on that platform, racked up more than 35 Million views and also released 5 feature documentaries.

Then, in July 2020, YouTube ‘nuked’ his entire channel literally overnight without any advance warning!

He is telling the story of how it happened as it was happening in this video he uploaded to the decentralised video platform Odysee.

Nowadays, Dan only uploads his full videos to censorship-free platforms like Rumble, Odysee and Bitchute whereas YouTube only gets a snippet/trailer of his videos, which is very wise move if you ask me.

Below is the trailer of this particular story and again, if you want to watch the story in full, you will need to go to Dan’s website.

This connection between the banking collapses and CBDCs is blatantly obvious to those who have been paying attention over the last few years, and especially since the start of the so called ‘Pandemic’ when there was a massive push to “go digital” on everything and especially on everything to do with money.

Even Ukraine got in on the action and while being at war with Russia has managed to find the time and resources to significantly accelerate its own “digital transformation” program, while making it much more Orwellian, which as you’ll soon understand, was always the intention (and not just in that country).

What is a CBDC?

You may not be familiar with that term yet so before we go any further let’s start with the basics so that we have a common frame of reference.

A Central Bank Digital Currency (CBDC) is, as the name suggests, a digital-only currency similar to Bitcoin.

This means it does not exist in a physical form (i.e. notes and coins you can keep in your wallet or purse).

However, unlike Bitcoin which is decentralised, which simply means it is not controlled by a single entity, a CBDC is absolutely and completely centralised and as the name suggests, it is controlled fully by a nation’s central bank.

Here are a few excellent introductory videos to give you further context:

Now, it is essential to understand that while both CBDCs and existing digital currencies such as Bitcoin and Ethereum share many common characteristics (chief amongst them is the ability to be “programmable” which I will touch on further in this article), they are diametrically opposed to one another.

‘Traditional’ digital currencies starting from Bitcoin were specifically and intentionally created to be insulated from any control and manipulation by the central banks and the government.

The Bitcoin whitepaper was released on October 31, 2008, on the tail end of the Global Financial Crisis and its mysterious author Satoshi Nakamoto (whose real identity we still don’t know to this day or even whether it is one person or a group of people) presented it as a potential alternative to the existing financial and payment systems which has built-in robust protection mechanisms against devaluation, inflation and financial exclusion.

The Ethereum whitepaper was released in 2014 by Vitalik Buterin and expanded on the capabilities of Bitcoin by first introducing the concept of cryptocurrency that can be programmable.

A CBDC on the other hand is never designed to be resistant to government interference or control.

As a matter of fact, the exact opposite is true!

It’s designed to have all the features of a digital currency (or cryptocurrency as it’s also commonly called) except decentralisation.

Instead, it is designed to allow central banks granular control over each and every currency unit, including where, how and by whom it is spent!

Here is a good video to help you further understand the very fundamental differences between CBDCs and the digital currencies (a.k.a cryptocurrencies) we have at the moment:

CBDCs are ‘programmable money’

Ok, so let’s get into more details about this ‘programmability’ feature of CBDCs as it’s one of the two aspects that are fundamental to understanding the unimaginable dangers this technology poses to the freedom and even to the very lives of each and every one of us (the other one being the fact they are fully controlled by the central banks as already discussed above).

Many people say that we are already using digital money and have been for a long time due to the fact that most of the currency supply of all major economies only exist in digital form as opposed to in the form of notes and coins.

While that is technically true, it does omit one important fact: this currency (whether in digital or physical form) cannot be programmed…but CBDCs can (and no doubt will)!

So how would that work in practical terms?

Well, once you have currency units of CBDCs in your digital wallet (which will be the only way to store them), they may:

Disappear after a set amount of time if not used. This means no savings!

Be restricted to only be used for certain purposes and/or certain locations or businesses. For example, you may not be able to buy a plane ticket with them to go overseas (because for example it’s “bad for the environment”) or buy red meat (for the exact same reason or any other reason the government comes up with).

Stop working if you say or do anything the government of the day deems to be inappropriate (e.g. speak against a certain medical procedure). You can be fined by remote control and at a click of button with currency units deducted from your CBDCs digital wallet or the wallet itself being disabled altogether. Sounds a bit far fetched? PayPal tried to do the exact same thing already not that long ago for customers of its digital wallet product.

This is something that is either very hard for governments and central banks to do in the current system we’re in, or impossible altogether.

Do you understand why CBDCs may be a problem…to put it mildly?

And before you think this is some kind of “conspiracy theory” and a hyperbole, have a read of this blog post on the website of the World Bank describing this exact thing and celebrating the great ‘opportunities’ it unlocks!

The state of CBDC rollout around the world

According to this statement from the Managing Director of the International Monetary Fund (IMF) given at the meeting of the Atlantic Council (which we will get to later) in February 2022:

“Around 100 countries are exploring CBDCs at one level or another. Some researching, some testing, and a few already distributing CBDC to the public."

Things are moving at a very rapid pace, much faster than you may have been aware.

The IMF have also released a report/research paper to accompany the above statement which you can find below:

Before we go any further, I want to highlight the fact that the Managing Director of the International Monetary Fund Kristalina Georgieva, who was the one that made the above statement, is one of the confirmed co-conspirators behind the COVID-19 Plandemic and the rollout of the injections as discussed in detail here:

Have I got your full and undivided attention now?

Other than the International Monetary Fund, the other major globalist body pushing very very hard for CBDCs is the Bank of International Settlements (BIS) also known as the “central bank for central banks” who are also one of the “subcontractors” of the global COVID-19 conspiracy.

The BIS released a report in June 2021 titled “CBDCs: an opportunity for the monetary system” which kind of gives you an idea of how they think about CBDCs.

Here it is below for your reading ‘pleasure’:

If you are not keen on reading their dribble/propaganda, the video below does a great job covering what the BIS specifically are doing in the CBDC space and what they are hoping to achieve (spoiler alert: you’re not gonna like it!).

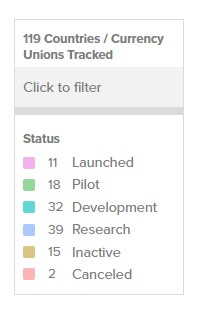

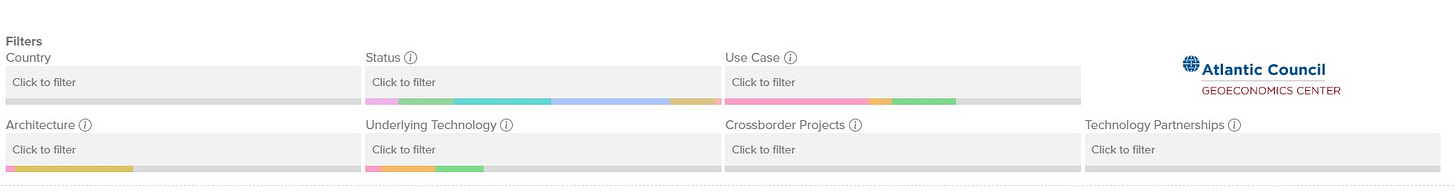

One of the best places to get comprehensive and reliable data about the state of the rollout of CBDCs around the world (and the one used by Neil McCoy-Ward in the video above) is the CBDC Tracker by the Atlantic Council.

The Atlantic Council is without a shadow of a doubt affiliated with the globalists!

When you look at its history and the number of its former and current leaders and scholars who also appear on the website of the World Economic Forum (such as this one, this one, this one, this one and this one) you don’t need to be a rocket scientist to reach this conclusion.

The CBDC tracker uses six categories to reflect the status of the CBDC project in each country:

And these are the different filters you can use:

Check where things stand in your country and if you see that your local CBDC project is either in the “Pilot” or “Launched” stage then GET CRACKING!!

(We’ll get to the actions you can and must take further below).

The US is currently testing CBDCs and this will likely accelerate significantly now with the collapse of FTX being used as an excuse.

In March 2022, President Biden issued an executive order in which he basically ordered the financial regulators in the US to pursue a path to a ‘digital dollar’ running on a distributed ledger technology, or in other words: a CBDC.

Here’s a story the great team at Redacted did on this and the accelerating attempts to roll out a Fed-run CBDC in the US:

The EU are not dragging their feet either and the European Central Bank (headed by another confirmed co-conspirator of the COVID-19 ‘Plandemic’) is full steam ahead on a ‘Digital Euro’:

In the UK, the government has already put ads out for 'Head of Central Bank Digital Currency' .

This is no “conspiracy theory”. Shit is getting real!!

Mandatory prerequisite for CBDCs

There is one thing that absolutely any CBDC rollout must have in place before a monetary system based on CBDCs can be made mandatory and replace the current fiat currency of a nation:

A fully implemented and mandatory government-issued (or government-endorsed) digital ID

Before I get into explaining what is a digital ID and how it facilitates the rollout of CBDCs, I want to highlight the most important point of this entire post:

Because CBDCs are 100% reliant on the digital ID infrastructure, digital IDs are the primary bottleneck for its implementation.

This means that if the implementation of a digital ID is stopped, CBDCs are dead in the water.

Therefore, we MUST KILL any attempts to introduce a digital ID, or at the very least delay them for as long as possible!!

What is a digital ID and why it is necessary for CBDCs?

A digital ID as the name suggests is a system that enables the definitive identification of a person through digital means.

One of the best ways to translate the above sentence into ‘real life’ is to think of a time when you used your Google, Facebook, Twitter or Microsoft account to login to another website without having to create a seperate login.

Every time you did that, you used that login as a digital ID with the only differences being that this digital ID:

Wasn’t issued to you by the government (but rather by a corporation); and

It wasn’t mandatory to use.

However, things are moving very quickly in that space as well.

For a very in-your-face demonstration of what a government-issued digital ID can and will be used for, here is a real promotional video by Thales, a proud WEF partner for their digital ID product:

How nice it is of Lucy’s 24/7 jail warden to ‘remind’ her of her “mandatory vaccination”. Lucy’s life is no doubt so much more ‘convenient’ now!

Speaking of mandatory vaccination, here is the work Thales are doing for the Canadian regime of Chrystia Freeland and her puppet/boy-toy Justin Trudeau:

One of biggest global players in the introduction of government-issued digital IDs is the ID2020 initiative.

This initiative was first launched in May 2016 at the United Nations Headquarters in New York, where a summit was held with over 400 people taking part.

The defined aim of the summit was to discuss how to provide digital identity to every man, woman, child and even infant on the planet which is one of the “Sustainable Development Goals” of the UN.

If the above paragraph hasn’t caused alarm bells to start ringing yet for you, the next one will, I guarantee it!

Below are the three entities that are driving the ID2020 initiative and they are also pushing another program to create a digital health ID, including a globally recognised digital vaccine passport (in collaboration with the World Health Organisation):

Let’s have a quick look at these ‘three amigos’.

Microsoft (and its founder) need no introduction.

Accenture is one of the biggest technology consulting companies in the world and is involved in pretty much every project to rollout a national digital ID, at least when it comes to western nations. Oh yea, before I forget: its CEO is another confirmed co-conspirator in the global COVID-19 conspiracy. Yea baby!

GAVI is the Global Vaccine Alliance and the organisations behind it speak for themselves.

At least two of the above organisations should get your alarm bells ringing like crazy and if not, you have some major catching up to do!

One also has to ask what a Vaccine Alliance has to do with the global push for digital IDs and if you want an answer to this question, the video at the top of the post below will answer that for you….but you probably will never ever be the same after watching it!

Don’t say I didn’t warn you…

Ok, so now you understand the basic lay of the land with regards to digital IDs and who is pushing for them (and probably freaking out…and very rightly so!) but what does all of that have to do with CBDCs?

Well, here’s the thing:

Unlike digital currencies/ cryptocurrencies like bitcoin and even more so, privacy-focused cryptocurrencies like Monero and Zcash, which facilitate the exchange of value in a decentralised and more importantly anonymous manner, CBDCs not only don’t support anonymous transactions but anonymity of any kind is the complete opposite of everything they stand for.

The whole purpose of a CBDC is for the central bank or the government to be able to definitively identify you and track every single transaction you ever make, for any purpose and with any person or organisation, and also be able to review/audit them at any time…forever!

This is why they need a digital ID as a prerequisite to rolling out CBDCs!

Once they have both a mandatory digital ID infrastructure and a CBDC as the only possible way for financial exchange/participation, they can do all sorts of ‘fun stuff’ like implement a social credit system, similar to the one they already have in the People’s Republic of China!

ID2020 is definitely not the only global initiative pushing for the rollout of digital IDs across the world. All the ‘usual suspects’ are in on the fun as well.

Finally, for a very good explanation of how digital IDs, CBDCs and social credit systems all tie in together, I strongly recommend you watch the excellent documentary “State of Control”.

The trailer for it can be found below:

If you watched the trailer above and are keen to now watch the full Movie, you can do so right here without even leaving this post.

I have no idea how long YouTube will allow it to stay on but if it’s ‘nuked’, the video is also available on Rumble and Odysee.

Things are on the move in the land down under…

In Australia (where a CBDC is already at the “pilot” stage which is last stage before launch), the government is frantically pushing the digital ID initiative in every way they can with legislation already in the final stages of ‘consultation’ before no doubt being steamrolled through parliament where the ruling labour & greens coalition have a majority in both the house of representatives and the senate.

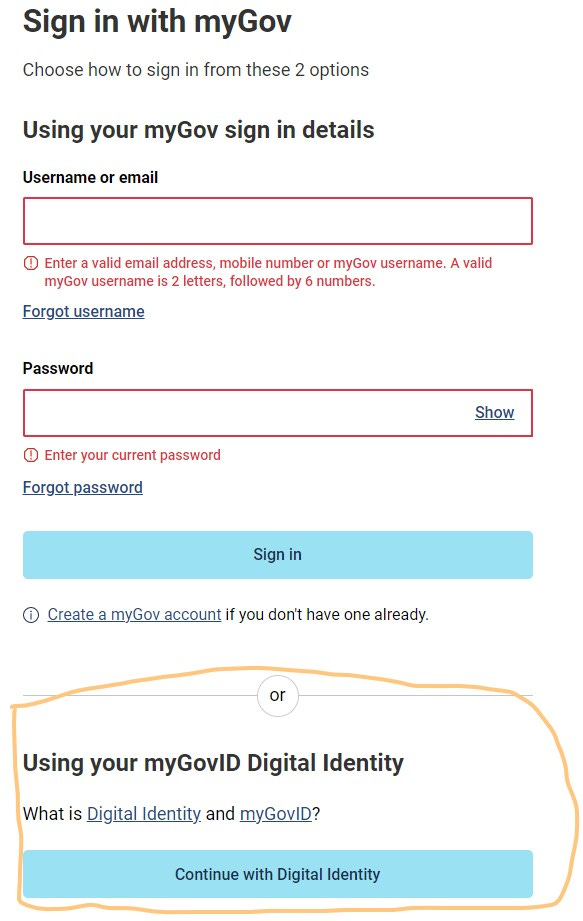

In parallel to that, the MyGov portal, which is now the primary way to access government services and more importantly, social security and other payments, is getting a major overhaul to integrate it with a government-issued digital ID service called “MyGov ID”.

The Australian government is saying this is “necessary in order to improve cybersecurity” following a spate of large and high profile data breaches that occurred recently and which resulted in some very sensitive personal information being made public by the hackers.

Already now, when you visit the login screen of the MyGov portal, you are presented with an ‘option’ to use your MyGov ID (a government issued digital ID) to access the system, instead of using a traditional email and password combo:

Care to wager how long before using MyGov ID is no longer an “option”?

While the federal government is doing that, many of Australia’s state governments are trying to sneak in a digital ID through their “digital driver’s license” initiatives.

Here is an example from Queensland:

Making the connection between bank collapses and rollout of government-issued digital IDs and CBDCs

Ok, so at this point you may have already made that connection yourself and if so, just skip this section to the next one where I discuss what you can do about it right now.

However, if you’re not there quite yet, keep reading.

Major breakdown of the financial system will be used as the pretext to significantly accelerate the rollout of CBDCs and even do so under duress

As Winston Churchill famously said:

“Never let a good crisis go to waste!”

If I am right (and I’m fairly sure I am), we are currently seeing the ‘opening shots’ of a financial crisis that will make the Global Financial Crisis pale in comparison and will even give 1929 a very good run for its money!

So here’s how you can shove CBDCs down people’s throats (whether they like it or not) in seven easy steps:

Step 1: several major banks collapse in quick succession. Whether this occurs on its own or manufactured is secondary.

Step 2: the ‘authorities’ call an “emergency meeting” to decide what to do to stabilise the financial system, prevent so called ‘contagion’ and stop a run on the banks from happening.

Step 3: said ‘authorities’ decide that the best way to prevent a disorderly disintegration of the nation’s banking system is to announce a temporary “bank holiday” and maybe also a temporary shutdown of the stock market. Now, you need to understand what that “bank holiday” actually means:

Bank branches remain closed;

ATMs either stop working altogether or strict withdrawal limits are introduced; and

Internet banking facilities and mobile apps are turned off (only ‘temporarily’ obviously…).

If this sounds far fetched to you, such things have actually already happened, and not that long ago.

Step 4: the ‘authorities’ announce that the only way to stabilise the country’s financial system is for the central bank of that country to take direct control over the banking system which means you will now be banking directly with them instead of with the commercial banks you currently hold your accounts with. They also say that further details of how this will work exactly will be announced “shortly”.

Step 5: the central bank announces that it is impossible/impractical for them to facilitate direct banking by the citizens under the existing fiat currency system. Instead, they say that going forward, a new digital currency managed directly by them will be introduced. Welcome to the nightmare that is mandatory CBDCs!

Step 6: the central bank will introduce an online portal where citizens can go to create their digital wallets (which will be the only way to transact) and in order to do that, they will have to use a digital ID! The portal will also offer them a ‘convenient’ way to create their digital ID, if they don’t already have one.

Step 7: once people’s digital wallets are up and running the central bank will ‘conveniently and seamlessly’ convert their existing balances from their traditional bank accounts to a CBDC balance in their newly created digital wallet. It is also likely that people will receive some additional ‘bonus’ CBDC units to encourage participation and “kickstart the system”.

CHECKMATE!!

If you think this is a bit out there, I suggest you read this post and watch this video featuring Clive Thompson who is the former managing director of Union Bancaire Privee, a swiss private bank and wealth management firm.

I think it is safe to say that Mr. Thompson knows a thing or two about banks and how they work.

Still think the above scenario is a bit far fetched?

Well, if you do, this has essentially already happened in Nigeria!

As the above video mentioned, while this is all happening in Nigeria, in the US, the final dominoes are all falling into place and it’s simply a matter of flipping the switch.

And said switch will actually be flipped in July with FedNow going fully live!

CALL TO ACTION: FIGHT as if your life depends on it (because it actually does) to stop digital IDs and CBDCs!!

Ok, so this is bad. Really bad.

“What can we do about it?”

Well, as I mentioned already in this post, there is one thing that a CBDC simply cannot exist without and that’s a digital ID issued and mandated by the government.

This is our best chance to stop this thing!

In order to stop digital IDs we need a two pronged attack:

Attack the “issued” part; and

Attack the “mandated” part.

Preventing the issuance of government digital IDs

Stopping any projects or attempts by the government to issue digital ID is the first and best step.

You are likely living in a country that at least officially is still a democracy which means the people comprising the government need to get elected.

This gives you some leverage, especially if the call to cease and desist from developing and rolling out digital ID is coming from many of your fellow citizens.

Therefore, the key to winning in this stage is mass awareness and there is no time to lose!!

If you read all the way to this point, you definitely know more about CBDCs, digital IDs and their implications than the majority of your fellow citizens.

As the great English biologist and anthropologist Thomas Huxley said:

"The great end of life is not knowledge but action".

Now that you have the knowledge, it is imperative that you ACT on it and encourage as many other people around you to do the same.

The first step may be simply sharing this post with them!

The next step may be creating some basic and easy-to-understand and distribute resources and simply start handing them out and also sharing them on social media.

Luckily, you don’t even have to create your own if you don’t want to or don’t have the time.

Reignite Freedom has created downloadable resources in 8 languages you can use as-is. Below are the ones in English:

Reignite Democracy Australia, which is one of the organisations behind the Reignite Freedom project mentioned above, has also created some specific guidance for Australians.

Preventing government issued digital IDs from becoming mandatory

This is our final line of defence which means that if that is the only option left to us, we are in deep trouble!

It also means that FAILURE IS NOT AN OPTION and we must succeed at this point, no matter what the cost is!

If there is one thing we all learnt from the days of the injection mandates and other government overreach measures during the ‘Pandemic’ (e.g. lockdowns, business and school closures, restrictions on travel etc) is that there is one thing that is absolutely crucial for the government to be able to mandate anything:

COMPLIANCE

If people simply refuse to comply and do that en masse, there isn’t much that the government can do!

Are they going to lock all of us up?

Are they going to deny all of us basic necessities like food and shelter and risk an outright rebellion?

Are they going to force us to sign up to a digital ID at gun point?

You see where I’m going with this…

If the previous stage of mass awareness campaigns fails to stop the introduction of digital IDs (which is possible because as we all know by now, the government is not necessarily serving its citizens but rather other ‘agendas’), our best defence is to collectively and forcefully use the two letter ‘magic word’ that has always been available to us (and will always continue to be available unless CBDCs become a reality):

Bonus section

If you want to really fully understand:

How banking, and especially central banking, works?

How they can and do manufacture crises to serve their interest? and

How something along the lines of CBDCs has always been their end goal from day dot?

I recommend you watch this excellent in-depth interview independent Journalist Kim Iversen did recently with leading economist Prof. Richard Werner who holds no punches and also explains things in very simple terms anyone can understand:

Actionable Truth Media is 100% Independent and does not receive any support from governments, political parties, advertising or sponsorships.

To allow me to continue this work and expand it further and in pursuit of the mission to “propagate the truth like a MANTRA”, your financial contribution is greatly appreciated.

You can support this work through a one-off or recurring donation.

This will not happen until after the election. The illusion of the market will be upheld for Biden. Trump is then being set up for a great fall. The Fed will slash interest rates and bail out any banks in trouble to make everything look great for the "election". The second Trump gets in run for cover. All Hell is going to break loose...