CBDCs are coming. Time to ACT!

a #RunOnTheMajors may be a feasible option to delay their rollout

Another week, another major bank collapse in the US.

As I predicted, First Republic Bank is no more and has been taken over by JPMorgan Chase with the FDIC (i.e the US taxpayer) essentially providing all the cash.

Or to put it more bluntly:

JPMorgan Chase has just gobbled up another one of their competitors using other people’s money (specifically, your money if you’re an American taxpayer).

This is the biggest banking collapse in the US since the GFC and the second biggest ever in US history (the biggest is still the collapse of Washington Mutual). This obviously eclipses the collapse of Silicon Valley Bank in March this year.

This is also far from over despite (and probably as a result of) what the ‘Town Jester’ Jim Cramer is saying.

No doubt any of these banks will also be gobbled up by one of the big banks in the US if they do indeed collapse…and the American taxpayer will foot the bill!

These occurrences of bigger banks swallowing up their smaller competitors are not new and not unique to the US. The same trend is being observed in Europe, Australia and Canada.

Furthermore, the frequency in which this is happening only seems to be accelerating.

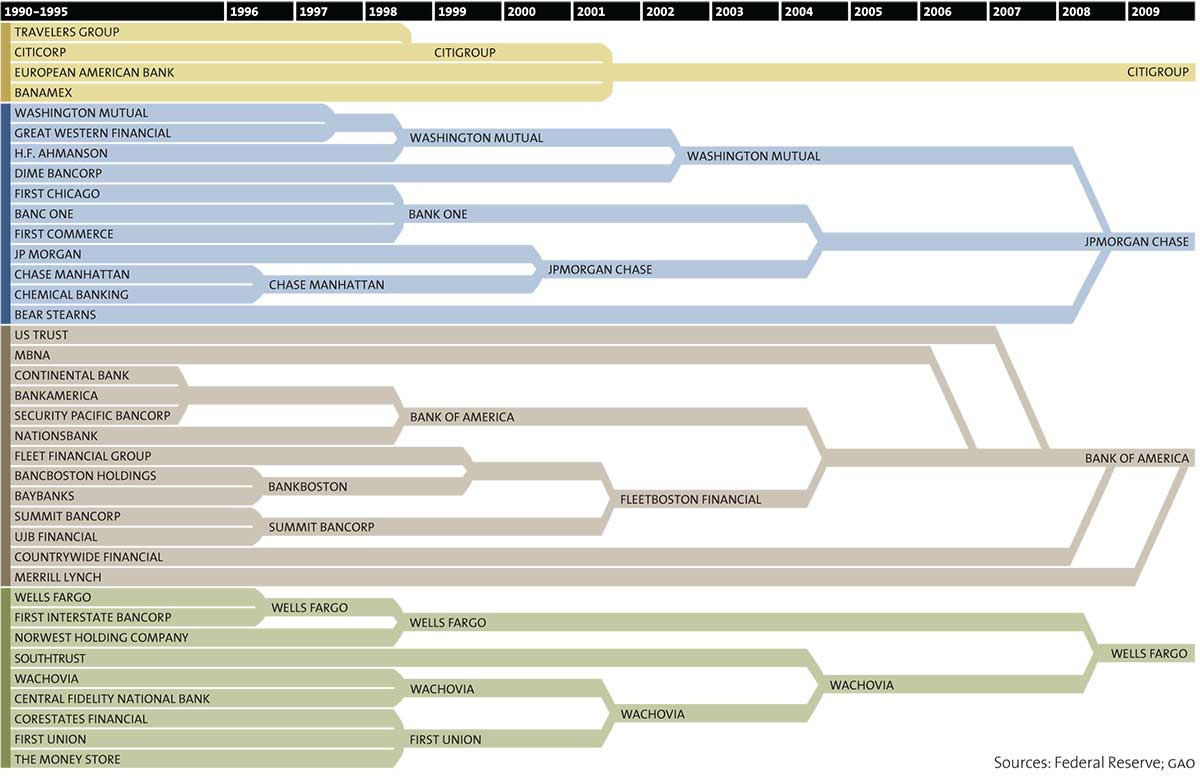

As an example, take a look at the diagram below which outlines in very stark terms how 37 American banks became just four (an 89% reduction!!) in the space of less than 20 years with most of the consolidation happening in just 13 short years!

Another interesting observation is the fact that while the GFC definitely contributed to it, this consolidation started well before that.

This is all by design

As we have all learned very well during the C19 Plandemic, major events very rarely happen in a vacuum and always (always!) follow a plan, often many decades in the making.

Furthermore, such plan is tested and refined on regular basis to make sure it performs at an ‘optimal’ level when it’s time to execute!

This is no different!

The FDIC which is the quasi-government agency responsible for ‘insuring’ all bank deposits under 250K (per bank) actually rehearsed this very scenario we have seen unfolding for the fifth time since the start of 2023, back in December 2022!

There is a lot of chatter about this so called ‘leaked’ video from the FDIC meeting and many are commenting that this is “fake news” because what is said in the video is being misrepresented and that it wasn’t actually leaked.

Well, the latter is actually true!

You can’t really call this a leaked video if it’s available publicly for all to see on the FDIC’s own website.

This also makes it very easy to assess the claim that what is said in the video is being “misrepresented”.

I have watched the relevant sections of this very long video (3.5 hours in total) discussed above and I don’t think it was misrepresented in any way.

The participants discussed how a bank seizure/closure by the FDIC should be handled, when is the ideal time to make the official announcement (Friday evening) and what the general public should be told before (nothing), during (very little) and after such seizure/closure (“the banking system is strong and we have taken decisive action to ensure this remains the case”).

So you see, major things such as the collapse of a major bank don’t just happen and I’ve already outlined the exact steps of how such banking crisis will be used as the perfect pretext to roll out Central Bank Digital Currencies (CBDCs) and how it’s very likely you will have little to no say on the matter and will basically have to either comply, resort to forms of payment not controlled by the government or even outright barter with like-minded people.

When you read it in that context, you will likely be terrified (as I was) to find out how easy it will be once all the moving places are in place, which as you will learn further down, they essentially already are!

Saying that, it seems like I didn’t outline the plan entirely accurately and have missed one important step those who pull the strings want to achieve first.

Consolidating the banking system to only a few massive players is the ‘enabling act’

This makes perfect sense and I don’t know how I didn’t see it earlier.

After all, when you have lots of commercial banks, community banks and credit unions all vying for your business, it is much harder for the top of the pyramid to ensure they all fall inline in the same way and at the same time when it comes to flipping the switch on CBDCs.

Instead, if you can remove most of them from the way and only have a few large ‘stakeholders’ who themselves are heavily involved in your agenda (both financially and ideologically), it makes things so much easier!

Said ‘stakeholders’ can also ‘assist’ with onboarding the masses to the CBDC infrastructure and provide ‘customer service’, using their existing channels the general public is already very familiar with and accustomed to.

This will not just increase uptake but also free the central bank to do more ‘important’ things such as ensuring all other forms of payment (including the national currency which preceded the CBDC) are effectively blocked.

Another major threat is cryptocurrency.

Gold, Silver and other precious metals are a great way to protect yourself from arbitrary actions by the government and their globalist masters but it does have one major problem: it’s often not feasible to transact with it due to the way modern society operates.

Transacting directly with precious metals and other commodities was OK a few centuries ago when most people were living in small communities, knew each other and had very little contact with the outside world but is not really possible in modern society.

Nowadays, we need to be able to transact with people and organisations separated from us by distance and do so quickly in order for the economy to function. Sending silver or gold coins in the mail is just not going to cut it.

We can obviously have another go at issuing paper certificates which represent holdings of precious metals or other commodities and use those to transact but given this is what gave rise to the banking system and eventually fiat currency, I’d argue that doing so definitely falls within Einstein’s definition of Insanity….

The only viable solution I’m aware of which allows easy and secure financial exchange between people and entities not located in close proximity and which cannot be controlled by governments and corporations is what’s called Distributed Ledger Technology (DLT in short) of which cryptocurrencies such as Bitcoin are the most prevalent use case at the moment.

There is only one catch: if you have currency issued by your government (which is called “fiat currency” from the Latin word fiat which literally means "authoritative sanction" or "let it be done") and you want to convert it to a cryptocurrency, you need to go through a cryptocurrency exchange.

These entities act as the ‘on/off ramps’ between crypto and fiat and while some of them are very sketchy, others are legitimate businesses.

Given these exchanges deal predominately with converting from fiat to crypto and vice versa, they need access to traditional (i.e fiat) banking facilities.

Kill their access to such facilities and you kill them…and more importantly, make it much harder for people to convert the fiat balance in their bank accounts to the cryptocurrency of their choice.

And what do you know?

A big part of the business for the now defunct Signature Bank and Silvergate bank, as well as Silicon Valley bank to a lesser extent, was providing banking facilities to such cryptocurrency exchanges!

The end game is (and always has been) a single global CBDC

After all, a one world government can’t really assert its authority effectively on every man, woman and child on the planet without a one world currency, no matter how many soldiers and weapons it has at its disposal.

That one world currency was always meant to only exist in digital form or in other words: a CBDC!

If you don’t happen to know exactly what CBDCs are and what is required in order to roll them out (namely a digital ID infrastructure), this section of the article below should provide a comprehensive introduction.

The inevitable bank collapses will be used to usher in Central Bank Digital Currencies (CBDCs)

At the end of last week, the news came out that the large US Bank, Silicon Valley Bank (SVB) “collapsed suddenly” and taken over by the FDIC. Below are two videos from independent media journalists covering this story. The first is just a quick runthrough of the facts:

More and more current and aspiring politicians are starting to understand the unacceptable risk to freedom posed by CBDCs and digital IDs, including Presidential candidate Robert F. Kennedy Jr. who is very clear and blunt about what this means for Americans.

‘Icebreaker’ is almost ready to break your freedom….forever!

My previous article already covered the immense dangers national CBDCs pose to our freedom and even to our very lives (kinda hard to stay alive if you can’t buy anything to eat or drink).

However, even this is not the end game.

The ultimate objective as I stated previously is to have one single global CBDC and once a big chunk of nations have their own CBDC, the consolidation into a single global CBDC is inevitable.

The system to consolidate all national CBDCs into one is already being built by the Bank of International Settlements (a.k.a the central bank of central banks).

Here is their promotional video:

And here is their full project report which you can also download from their website.

Now in case you haven’t heard about the Bank of International Settlements (BIS) before, they are a major component of the globalist infrastructure as I discuss in great detail in this article:

Long story short: this organisation and the people they work for don’t have your best interests at heart (to put it mildly) and definitely not your freedom!

Another project which caught my eye in this context is the Universal Monetary Unit (UMU) which was unveiled during the last meeting of the International Monetary Fund (IMF), the biggest ‘player’ so to speak in the globalists' financial infrastructure of enslavement and whose Managing Director as well as her deputy are confirmed co-conspirators of the COVID-19 Plandemic!

The UMU is not a project run directly by the IMF but rather by a very mysterious organisation calling itself the Digital Currency Monetary Authority (DCMA) which despite its very ‘official’ sounding name is, according to its own press release:

a private organization that advocates for the advancement of digital currencies in central banks and money systems.

The executive team has been working with governments and central banks on blockchain and digital currency cryptography since 2013.

A glance at their website reveals very quickly that CBDCs is what they are all about instead of any other type of cryptocurrency.

The UMU they officially ‘unveiled’ last month will run on their Crypto 2.0 network which they themselves say is “For Central Banks and Financial Institutions”.

This hopefully makes it abundantly clear who they see as their customer for this project…and it’s definitely not you or me!

Finally, the person heading this very official sounding ‘Authority’ (which is anything but) is a guy by the name of Darrell Hubbard.

Mr. Hubbard is a proud member of another organisation called Government Blockchain Association (GBA) who describe themselves as:

International nonprofit professional association with its headquarters located in Fairfax, Virginia.

GBA focuses on its members as individuals and organizations that are interested in promoting blockchain technology solutions to the government but does not advocate for any specific policy position.

Are you getting some bad vibes from this? I sure am!

They proudly state that their members (of which the head of the Digital Currency Monetary Authority is one) are spread across more than 500 government organisations all over the world, including the NIH in the US, NHS in the UK, the Provincial Health Services Authority in the Canadian province of British Columbia as well as the UN, the EU, the FDIC and the FTC.

Maybe it’s just me but I’m definitely getting a “we penetrate the cabinets” vibe from this.

Finally for this section, if you happen to live in Canada, your central bank is currently running “public consultations” in preparation for the launch of the Canadian CBDC.

You may want to let them know what you think about the whole idea but I doubt if they will care much about what you have to say. Either way, it may be worthwhile to follow this process as it may provide you with vital intelligence of how the digital-only version of the Canadian dollar will be rolled out and how long your physical coins and notes may still be usable for.

Know thy enemy

We MUST stop CBDC in their tracks. Here’s one practical way

OK, so now you know that CBDC (both national and global) are progressing at much faster pace than your local TV news have led you to believe (if you still watch their dribble).

You also know that in preparation for the rollout of CBDCs, the powers that be are accelerating the consolidation of the banking system in many countries and especially in the US where this is now happening so fast it is almost impossible to keep track of.

It is very obvious now that they want each country to eventually have no more than half a dozen banks at most so that the rollout of CBDCs is more ‘streamlined’.

So what can you do about it?

Well, as I covered already in the article below, it is obvious that the globalists are all about centralisation in order to consolidate their power and make the “unwashed masses” & “useless eaters” easier to ‘manage’.

From their perspective, this applies not just to finances but to every other aspect of human existence, including public health (a stupid term in itself) and even religion and spirituality.

A Great Reset is INEVITABLE!

Humanity has arrived to a fork in the road. It is my personal opinion that we have faced such forks many times before in our history (which is much much longer than what we have all been led to believe). This is another one. It could be the most important one yet but I’m just not sure to be honest as I believe we are a speci…

As I explain in the article above, the most effective way to fight these plans is to work towards the exact opposite of what the enemy is aiming for.

If they want to centralise, we all must do everything in our power to de-centralise everything!

If the majority of people keep most of their money in a few big banks, this works in the enemy’s favour as it creates a highly centralised banking system, especially if those that are responsible for managing it are complicit or stupid (and ideally both as far as the enemy is concerned).

Get your money OUT of the big banks

Regardless of where you happen to live (and especially in the western world) there are a handful of banks in your country that are the local banking ‘behemoths’ and hold most of the deposits at the moment.

In the US, there are four and their logos are on the image at the top of this article.

Given all the banking collapses that have already happened in the US since the start of this year (and we’re not even half way into 2023 yet), the information below is probably most urgent for you if you’re American but the same general principles apply even if you’re not.

Your first course of action is simple:

Withdraw as much money as possible in cash (while you still can) and transfer the rest to an account in a smaller bank and ideally a community bank or if you happen to be American, to a bank that is not a member of the federal reserve such as State-Chartered Banks.

Credit Unions and member-owned community banks for the win!

While credit unions and banks may not be able to resist the CBDC ‘onslaught’ and other totalitarian measures imposed by governments and their enforcers/regulators forever, I am convinced they will be amongst the ones that will go the distance for the longest time.

This is because they are the ones in the banking system whose interests align the closest with their customers due to the fact the customers are also the owners.

The more of these we have, the more options we have to protect ourselves from our own governments and their ultimate masters.

Therefore, it is imperative we support these institutions to ensure their long term viability and survival.

Here are some resources to help you do just that:

If you are based in the US, you can find your local community bank here.

If you are based in Canada, you can find your local credit union here.

If you are based in the UK, you can find your local credit union here.

If you are based in Australia, you can find your local community bank or Credit Union here.

If you are based in New Zealand, you can find your local credit union or building society here.

A great resource for identifying the right local bank for you is provided by the Solari Report run by Catherine Austin Fitts, a name you are likely to be familiar with but in case you’re not, this lady has a very long history in the US financial system including Assistant Secretary for Housing of the Federal Housing Commissioner in the U.S. Department of Housing and Urban Development, Board Director of Wharton Business School Club of New York and also ran her own hedge fund for almost 8 years.

In case you are not sure whether this lady is actually on our side so to speak, given her history, hopefully this interview will put your mind at ease.

She is one of the leading voices sounding the alarm globally about the risk of CBDCs and digital IDs.

“But Isn’t it risky to move my money to a smaller bank? What happens if it collapses and I lose everything?”

Very valid question!

Firstly, before we go any further I want to add a disclaimer that I am not your (or anyone else’s for that matter) financial adviser and simply voicing my personal opinion based on my own understanding and research.

Any action you choose to take, or refrain from taking is on you and I definitely suggest you inform yourself of the various risks of each action and then weigh it against the benefits. This includes making a decision to do nothing.

I will outline below the results of my research to help you do that but definitely suggest you don’t take these as gospel and do your own research on top of that.

After all, I am just a guy on the Internet… ;)

The question of the “Deposit Guarantee”

Many countries have schemes whereby the government or a quasi-government agency guarantees customer bank deposits. This is usually up to a certain limit.

In the US, the FDIC insures deposits up to 250K per customer per institution for “eligible accounts” which include all checking and saving accounts, as well as Certificates of Deposit (CDs).

The same limit applies in Australia whereas Canada and the EU only guarantee up to 100K per customer per institution and the UK only 85K.

Having a deposit guarantee should mean that at least theoretically, you should feel free to move your money to a smaller bank and enjoy the exact same protections for it as if you kept it in one of the major banks.

The reason why I say theoretically is because if your bank fails, you are still indirectly on the hook as a taxpayer.

If you look at the recent bank collapses in the US, no one lost their insured deposits and in the case of SVB, even the deposits that are above the 250K limit of the FDIC were “made whole” by the Biden administration.

However, someone eventually needs to pay for these bailouts. That someone is you if you happen to pay taxes in the US.

If you are in a country where there is no government guarantee/insurance scheme on deposits then you may be more apprehensive and rightfully so.

However, here is something worth considering in my humble opinion:

Which bank is more likely to engage in risky lending, derivative trading and other ‘financial engineering’? A large bank or a small community bank or non-profit credit union?

I will leave you to contemplate on the answer to this question and its consequences to your personal circumstances.

“Too big to Fail”

Ah, yea. That old chestnut…

Look, I get it. The so called “financial experts” on the idiot box (TV) use this term like its going out of fashion.

The legacy media is very much pushing the narrative that if you keep your money in a big bank, it is “safer” because the government will never allow it to go out of the business and for you to lose any of your money.

The government doesn’t directly endorse this message but often uses terms like “systemic risk” when talking about big banks leading you to believe that if you have your money with these institutions, the government has got your back more than if you had your money elsewhere.

So, is your money actually safer in a big bank because it is “too big to fail”?

Well, ask the people of Cyprus to tell you what happened to their bank deposits (including those that were insured) a mere 10 years ago.

Specifically, ask the customers of the Bank of Cyprus, the biggest bank in the country and one of the oldest, to tell you how they woke up one morning to discover they lost 6.75% of any deposits they had within the limits of the deposit guarantee scheme (€100,000), and 9.9% of any deposits above €100,000.

They took the bank and their own government to court to try and recover this money and the court basically told them to take a hike (but in ‘legal speak’).

Keep in mind that this is Cyprus, not Zimbabwe.

While Cyprus is definitely not a rich or highly influential country, it is nevertheless a developed European nation and a member of the EU.

So much for “too big to fail”.

Another point worth considering is the fact that as big banks have a bigger share of the deposits, they are more likely to have total amount of deposits which exceeds the amount the government or its agent have put aside to pay out people who lost some or all of their insured deposits due to the bank collapsing.

Nowhere is this more stark than in the US:

The FDIC which is the government agency administering the deposit guarantee had a total balance of $128.2 billion in its deposit insurance fund as of December 31, 2022 (so before any of the recent bank collapses).

Sounds a lot, right?

Well, the total amount of bank deposits in the US is over 17,167 billion (so almost 17.2 Trillion) and out of those 10.02 Trillion are insured (which means each individual deposit is under the 250K limit).

Simple math tells us that the FDIC only has enough money to cover 1.27% of insured deposits!

If you’re American, How safe are you feeling now?

But wait, there’s more!

As of December 31, 2022 (so before any of the recent bank collapses), the total deposits held by the four biggest banks in the US were as follows:

JP Morgan Chase - $ 2,014,513,000 (so just over 2 trillion)

Bank of America - $ 1,929,333,000 (so just under 2 trillion)

Wells Fargo - $ 1,399,274,000 (so just under 1.5 trillion)

Citi - $ 777,024,000 (so just over 0.75 trillion)

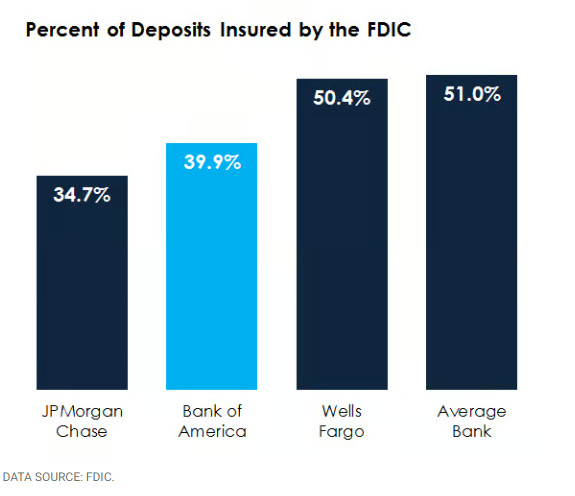

The analysts at Motley Fool went through the FDIC’s own database (which you can access here) to figure out what percentage of the total deposits in America’s three biggest banks are technically insured by the FDIC and have come up with the following:

Here is what this means in actual numbers:

Total insured deposits at JP Morgan Chase: $699,036,000

Total insured deposits at Bank of America: $769,804,000

Total insured deposits at Wells Fargo: $705,235,000

Total amount in the FDIC deposit insurance fund: $128,200,000

These figures are all accurate as of December 31, 2022.

Keep in mind that the total amount of deposits (both insured and uninsured) has almost certainly increased substantially since than due to several US banks collapsing and the resulting ‘flight to safety’.

This is especially true for JP Morgan Chase who have taken over all the ‘good’ assets (loans) and ‘good’ liabilities (i.e deposits) of the collapsed First Republic Bank.

Any questions? Still think it’s safer to keep your money in one of the big banks?

Other options you may want to consider

Withdrawing as much of your money from the bank as possible and feasible for you and using cash as much as possible is definitely a much better approach than doing nothing and pretending/hoping nothing is happening and that your government will look after you. No argument there.

However, let’s not kid ourselves that this is a panacea or that physical notes and coins are the “people’s money” as some pundits claim.

Sure, using cash means that you can keep your purchases and other financial transactions private and untraceable to you. This is an undisputed fact!

However, those notes and coins are definitely not the “people’s money”!

Fiat currency by its very definition only has any value because the government said so! It is not backed by anything other than your government’s word and their ability to enforce their will through taxation and sending people with guns to your house.

The intrinsic value of those pieces of paper and plastic is zero and the metal coins also have very little intrinsic value.

Most importantly: because this is actually the government’s money and not the “people’s money”, they can decide at any point that the cash you have is now worthless and has to be exchanged for new notes and coins, or worst yet: a digital-only currency they issue (i.e a CBDC).

This is not just me making a hyperbole but has actually already happened very recently.

The African nation of Nigeria forced all its citizens to exchange their existing notes for newly designed ones (supposedly to “increase security”) and then made this new currency very hard to come by thus severely restricting the people’s ability to use cash.

This was soon revealed to be part of a deliberate and carefully planned agenda to make Nigeria a completely cashless-society running exclusively on a CBDC.

So by all means, use cash to protect your financial privacy while the option is there but don’t buy into the claim that it is the “people’s money”.

Other options to consider except using cash and keeping your funds in smaller banks

Buy farmland if you have the money to do so without taking a bank loan. If Bill Gates is doing it, maybe you should too!

Push your purchases of goods and services forward - if there is something you need, buy it now especially if it’s tangible and durable goods such as seeds, tools, ammo and non-perishable/long lasting food. This means you diversified your assets outside the financial system and into something that can’t be easily manipulated or outright taken away from you. It will also mean you don’t keep losing purchasing power as inflation gets worse.

Buy precious metals like gold and silver - while your ability to transact with these metals may be quite limited as they are not really fungible, they have proven themselves to be good stores of value. The main caveat though is that if you decide to go down this route you must

:Only buy physical and not some paper certificates or ETFs where you have no way of knowing that they are actually backed by anything which makes these no different than fiat currency; and

Store it yourself (i.e. self-custody). This may present a real challenge, especially if you want to get large amounts.

Get some Crypto - this is a very deep rabbit hole and will involve a steep learning curve if you’ve never been exposed to this topic previously. I strongly recommend you educate yourself on Cryptocurrency extensively before jumping in and understand that not all crypto at the moment is truly decentralised or private. As a matter of fact, most of the major cryptocurrencies at present such as Bitcoin and Ethereum are neither (in my opinion at least). Another absolutely crucial thing to understand with Crypto is that self-custody is non negotiable! If you buy any crypto and then keep it on the exchange you bought it from or in any digital wallet you don’t hold the private keys for, you don’t actually own it and it can be taken away from you easily by hackers or the government. “Not your keys. Not your Crypto” is the MOST fundamental concept to understand about cryptocurrency. Until you fully grasp the meaning of that sentence, do not dare to get into crypto!

Can you think of any other viable options? Please suggest them in the comments below.

Spread the word

If everything I said in this article makes sense and resonates with you, and especially the part about moving your funds out of the major banks, please share this article anywhere you can.

If you share it on any social media platform that supports hashtags, I kindly ask that you also include the hashtag #RunOnTheMajors with any public post you make.

Let’s get #RunOnTheMajors trending!

When it comes to Twitter specifically, its new owner Elon Musk has recently decided he doesn’t like Substack anymore (the platform on which this article is published) and as a result the Twitter algorithm is aggressively restricting the reach of any posts which include substack links.

Therefore, if you do share this article on Twitter (which I definitely encourage you to do as it is one of the best platforms to get hashtags trending), please use the following link instead to fool the algorithm:

Another great article Michael, thank you!

Great article. It explains the whole plan in detail. Thank you for sharing my post about Nigeria going cashless.